Looking to go global with your product or service but not sure where to start? Global eCommerce represents a $4 trillion dollar growth opportunity. Take a look at this chart for the top nine countries, sorted by eCommerce market size. These countries are your best bet if you are looking to expand globally. Shoppers want a local experience when buying online – not everyone has international credit cards and shopping cart abandonment rates are as high as 67% for merchants not offering a local experience.

Let’s pay special attention to Germany, China and Brazil, where the success of your online store will depend largely on whether you are able to offer your customers the local payment methods and features they are most familiar with.

Germans are not particularly fond of credit; they prefer to only spend the money they know is already in their account, reason why Credit cards have never been a success in this country. In Germany, Cards take only around 10% of the total number of transactions conducted online. Bank Transfers (such as SOFORT and Giropay), SEPA direct debits, ELV (local direct debit), and PayPal account for 80-85% of the total payments market share.

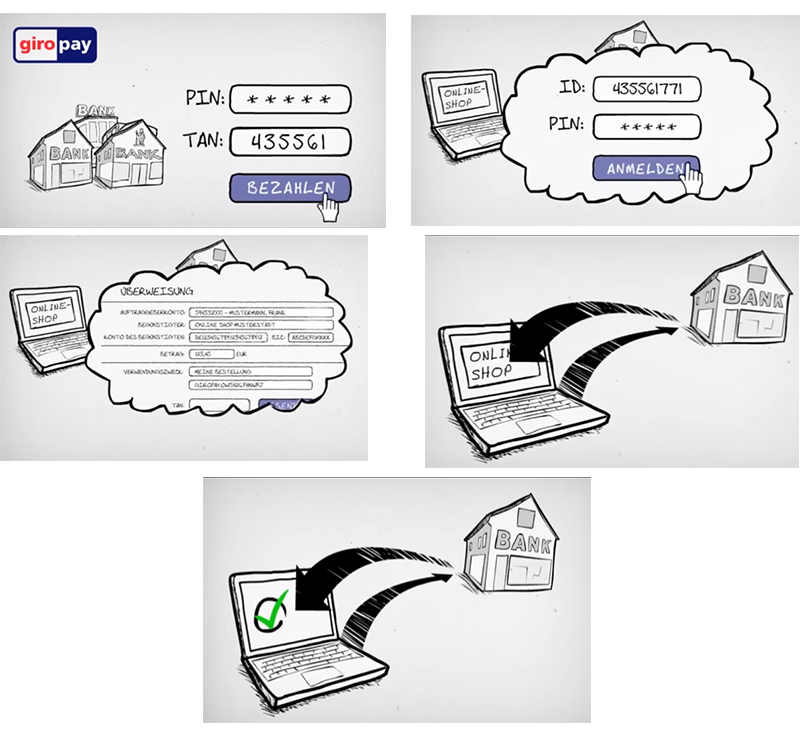

Bank transfers options are all relatively similar, and are shopper’s favorites due to their simplicity: they never get added a surcharge by merchants (like debit and credit cards sometimes do), and funds come out of their account instantly making these payments very easy to keep track of. They are also extremely easy to use. The shopper has often a user and a PIN with their bank, which they introduce when selecting this payment method. They get displayed all the information about the specific purchase. They agree to the transfer to this particular merchant, and this initiates an immediate transfer from their bank to the merchant’s bank.

The most common online payment method in the Brazilian market is cards, although there are still a considerable proportion of cards for domestic use only. Installments is also very popular for card-based payments. These are popular in countries with traditionally high inflation rates. The shopper agrees to buy a product at today’s price, paying in a number of agreed (generally monthly) installments often without added interest rate. As so many retailers offer this option, this feature could be the deciding factor for closing the sale.

Boleto Bancario, a cash-based payment method is also very popular amongst consumers, mainly those who don’t have a bank account, or their use is restricted to certain types of purchases which often exclude eCommerce. The merchant, via its PSP presents the shopper with a voucher, pre-filled with their details and with a bar code that the shopper takes to participating high-street shops or banks where they pay by cash. The shop reads the bar-code which communicates back to the PSP that the purchase has been complete and payment received.

The number of internet users and online shoppers in China is rapidly growing too. It has one of the fastest BtoC eCommerce growth rates.

However, Chinese shoppers will be expecting to be able to pay with their locally branded payment card, China Union Pay, or the very popular eWallet, AliPay.

The user experience on Alipay’s mobile app is designed based on actual usage scenarios. For example, users can transfer money to other Alipay members and share or split bills among them using QR codes. Alipay can be used to pay utility bills, top up mobile phone credits, buy train tickets or check the balance of a connected bank account. Alipay has partnered with many small businesses to allow its users to make payments on many Chinese websites and at an increasing number of offline shops. Alipay is a fully integrated and user-centric solution that covers a great variety of payment needs in people’s daily life.

Make sure you’re working with a payment processor that makes it easy for you to present your product in the shopper’s local language, currency, and preferred local payment types. These offerings will help drive higher sales and increase your bottom line.

Want to see more on how to go global? Follow us on Twitter @BlueSnapInc or subscribe to our blog.

Sources:

- eCommerce Foundation (2015 figures)