Mobile wallets have become a major buzzword and are a growing factor in payments and eCommerce. Yet, you might still be wondering what exactly they are and how they can benefit your business. Don’t worry, we’re here to help.

Simply put, a mobile wallet stores a shopper’s payment details, such as their credit cards or bank account information. The wallet then enables the shopper to make a payment or purchase using their stored payment details.

Why are mobile wallets important?

The number one reason for shoppers to use mobile wallets is convenience. As we all know, filling out forms can be painful and slow, especially on mobile devices. Using a mobile wallet means that the shopper does not have to manually enter and billing, shipping, or payment details. There’s also no need for them to pull out a credit card to get the security code, or go hunt for their bank account routing number.

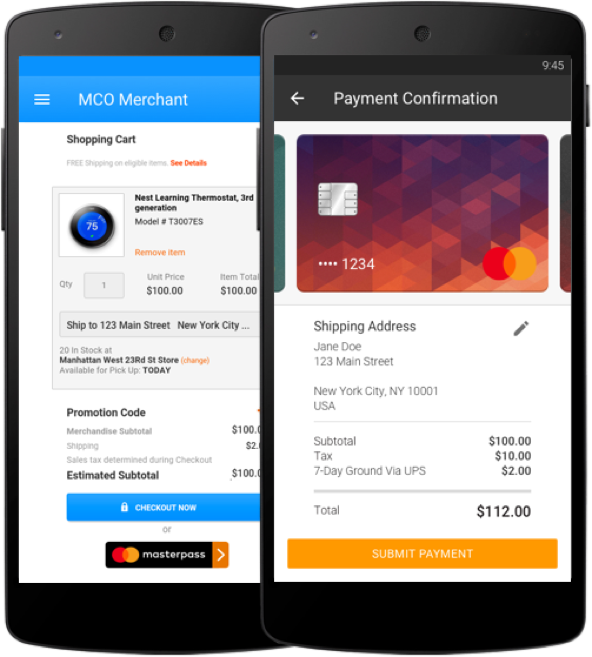

Checkout using a mobile wallet is reduced to a few quick and secure steps: sign in, choose the payment method, and confirm. Boom. The checkout pain is gone.

That’s very good news for merchants. Time to checkout, and the number of clicks involved, are key indicators for checkout abandonment, according to the PYMNTS Checkout Conversion Index. This is especially true on mobile devices, where filling out a complicated payment form can be a real challenge.

The merchants who achieve the best conversion rates are the ones who have made checkout simple and fast. Since mobile wallets deliver the shortest route to checkout, they make it easy for you to offer a frictionless checkout experience that is unified across desktop and mobile channels. This is a surefire way to give a sizable boost to your payment conversions. For example, shoppers using Visa Checkout have a 51% higher conversion rate than shoppers using traditional checkout methods.

Major brands like Avis, Ticketmaster, Under Armour and Wayfair know the value of delivering the best shopper experience, and they have already jumped on board with mobile wallets, building these payment options right into their checkout flows.

So how do you take advantage of the mobile wallet trend?

First, you need a payment gateway that supports mobile wallets. BlueSnap is on the leading edge of payment gateways for mobile wallet support, with offerings already for Visa Checkout, MasterPass, and PayPal, plus new integrations with Apple Pay, Android Pay, and Amex Checkout coming soon.

With BlueSnap’s Hosted Checkout pages, the mobile wallet payment options are built in. In most cases, you can turn them on with the flip of a switch. Then they’ll automatically be displayed as an available payment method on your checkout pages. It really couldn’t be easier.

If you are using BlueSnap’s Payment API, you can offer mobile wallet payments by adding the relevant wallet button to your checkout page and then using the wallet info to process the transaction through the API as usual. We’ve built detailed tutorials for MasterPass, PayPal, Apple Pay and Visa Checkout to help you painlessly set up your API integration.

Give it a try. With minimal effort, you can see a serious increase to your payment conversion rates. To get started, check out our guides, or reach out to our support team. Your shoppers will appreciate it, and so will your bottom line.

Here’s a two-minute video to get you started with mobile wallets: