The Best Way to Process Cross-Border Payments Is Locally

Thanks to technology, accessibility and the Internet, our world has gotten smaller. We can easily communicate, work and even sell across borders. As businesses look to expand, introducing products and services to new geographies is the natural next step.

International selling is the future. It’s true that domestic eCommerce is growing, but cross-border eCommerce is exploding. Consider these statistics to see how enabling cross-border payments could put your growth in hyperdrive.

Fast Check

2.1 billion global digital consumers in 2021, projected to increase by 22% in 2023 1

51% of global consumers say they’ll do more cross-border online shopping 2

20% of global eCommerce sales will be cross-border by 2022 3

$4.8 trillion projected eCommerce growth by 2026, up from $780 million in 2019 4

$250 trillion projected value of all cross-border payments by 2027 5

95% of all purchases will be made online by 2040 6

If you’re selling online, then there’s a chance you’re already starting to sell cross-border. To grow effectively on an international scale, you need a good way to manage cross-border payments – transactions that involve an exchange of money across the border of a country or region – while avoiding unnecessary cross-border fees and the pitfalls of global compliance.

Yet, when we asked companies about how they localize payments for their global customers, only 50% sold in customers’ local currencies and a full 15% of respondents took no localization action whatsoever! That’s neglecting an increasingly important area of sales and business growth and creating the likelihood of checkout abandonment.

This guide walks you through cross-border payments and associated cross-border fees, highlighting the benefits to expect and risks to avoid. You’ll also learn what features you need in a cross-border payments solution to fully capitalize on the continued growth of global eCommerce.

In this guide, you’ll learn about:

What Are Cross-Border Payments?

Cross-border payments, or cross-border transactions, involve any exchanges of money that cross the border of a country or region, starting in one jurisdiction and ending in another.

When banks process cross-border payments, they perceive them to be riskier than domestic transactions. This perceived risk leads to higher fees and a greater likelihood that the transactions could be declined.

Types of Cross-Border Payments

Cross-border payments can take any of the same forms as domestic payments so it’s important to be able to accept all types of payments, including types native to the particular countries where your customers are located. Two of the most popular payment types, that can also incur cross-border fees, are credit cards and eWallets:

- Debit and credit card payments

Perhaps the most traditional form of cross-border payment is an online card payment. This is a transfer of money via a card issued by a financial institution, typically a bank, that gives an individual access to their own funds or a line of credit.

- eWallet payments

eWallets, or digital wallets, are a type of software application that stores an individual’s payment information to allow the digital transfer of funds between users. They are often used through mobile payment devices, such as smartphones or tablets.

How Cross-Border Payments Work

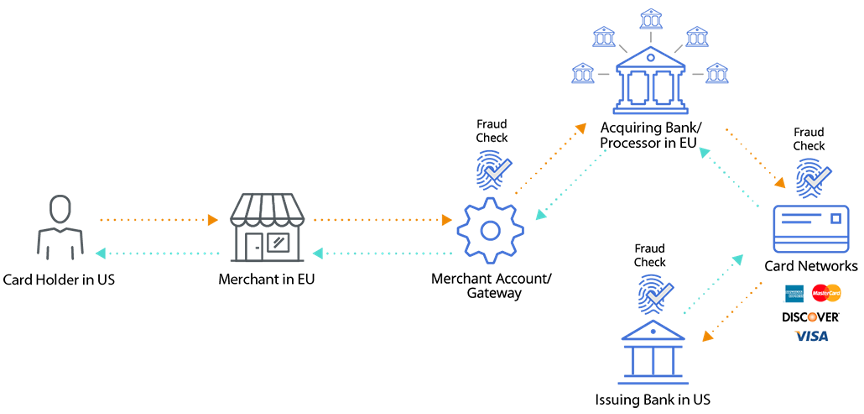

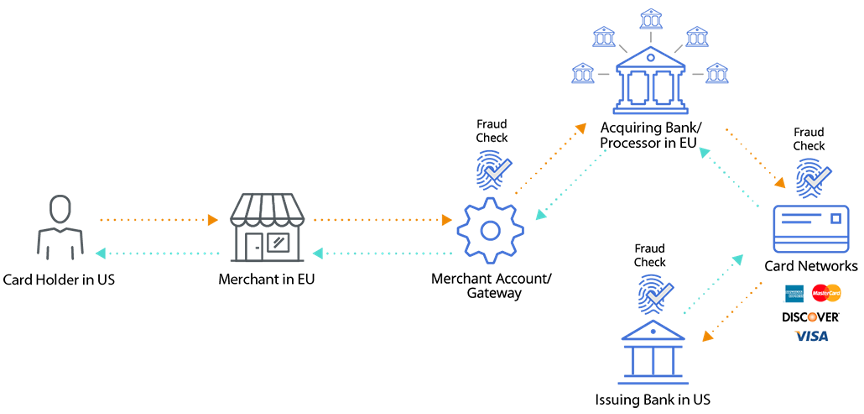

Payment processing follows the same seven steps whether a transaction is domestic or international. However, cross-border payments have some additional considerations that, if addressed, will help you make the most of your international sales. Here’s how they work:

1. The customer purchase: Your customer arrives at your checkout page, shopping cart filled with merchandise (or services or software), ready to make a purchase. They choose a payment method and enter any required information associated with it.

For cross-border payments: To make cross-border eCommerce a success, this step requires some extra attention — a localized checkout experience. The checkout page should always be presented in the shopper’s language. According to a global survey, 76% of shoppers prefer to purchase products presented in their own language and 65% prefer website content that’s in their language, even if it’s of poor quality.

Not only does this make the customer feel more comfortable navigating the page, but it also feels more like a local shopping experience, making it more likely that customers will see the process through. A payment gateway with an emphasis on cross-border transactions will detect the shopper’s IP address and serve up the appropriate experience.

Similarly, the price of your goods should appear in the shopper’s local currency. This is important for two reasons: One, it helps your customer know exactly how much they’ll be paying, without making them jump through hoops by doing currency conversion calculations. Two, it’s more likely that the transaction will be approved by the acquiring bank (see step #2). Again, a simple IP check by your payment provider should provide the shopper with what they need.

Lastly, your checkout page should offer local payment methods — no matter what country your shopper is in, they should be able to choose whatever method of payment they use normally. Without local payment options, you risk losing the sale altogether; at the very least, your customer won’t be completely satisfied with the experience.

2. Routing and processing: In this step, the customer’s card information is captured and encrypted by the payment gateway. The gateway then sends an authorization request along with the transaction information to an acquiring bank — the bank or financial institution that processes credit or debit card payments on behalf of the merchant (you). The acquiring bank then sends the request to the issuing bank — the shopper’s bank — to request approval to process the transaction.

For cross-border payments: To conduct cross-border eCommerce transactions more effectively, a payment solutions provider should partner with numerous acquiring banks around the globe. Some payment providers only have one acquiring bank partner, so it’s important to check! Why? A one-bank partnership sets up global payments for failure. If the acquiring bank is located in the US and the shopper’s bank is in another country, that transaction has a much higher probability of being flagged for fraud.

3. Approval: In the approval phase, the issuing bank either approves or denies the request. That decision might seem like a no-brainer — either funds are available or they’re not — but the decision is based on a few different factors, including availability of funds, transaction value, etc.

For cross-border payments: Approval becomes more challenging for cross-border payments because there is the potential for more risk. Banks consider the same factors when authorizing any transaction, but with international sales, there’s more likely to be a mismatch:

- Funds: Are the funds available to cover the amount of the transaction?

- Transaction value: Lower value transactions have a better chance of being approved as higher value transactions are seen as higher risk. If you have higher ticket items, you might consider offering a subscription plan to be able to offer lower value transactions to increase the chances of approval. For example, rather than charging $120 a year to access your software, charge a monthly $10 fee.

- Currency mismatch: If the currency request doesn’t match the issuing bank’s local currency, the transaction is more likely to be declined.

For cross-border payment processing, the approval step goes more smoothly when transactions are routed to the banks most likely to approve them — banks that are a good match geographically and that fit the transaction’s currency and issuing bank or country. This type of “intelligent” routing helps increase approval rates.

4. Shopper results and confirmation: Once the issuing bank has made a decision, it informs the acquiring bank, which authorizes the transaction and then informs the customer via the checkout page as well as you, the business.

All of these steps happen in about a second.

Figure 1 – From purchase to confirmation, the steps of a cross-border eCommerce transaction happen in just under one second.

For cross-border payments: More potential obstacles exist at every step, including getting flagged as a fraud risk, running afoul of regulations or having additional fees applied.

Once a transaction has cleared, then you can head on over and start the next phase.

5. Order fulfillment: Enough said — you know what happens here.

6. Settlement and payout: In this stage, you, the merchant, receive the money owed to you for all those global transactions. For each approved transaction, the issuing bank sends the appropriate funds to the acquiring bank, which then passes them on to you, sometimes via a payment solutions provider like BlueSnap. You usually have the opportunity to determine how frequently you’ll get paid — either daily, weekly or monthly.

For cross-border payments: Typically, foreign exchange fees (called FX fees) apply for merchants that prefer payouts in their local currency. However, some providers offer like-for-like payout options, which means they are capable of paying into your multi-currency bank account in the original transaction currency. Merchants that take advantage of this option can save money on FX fees.

7. Reconciliation: Similar to balancing your own personal checkbook, reconciliation is how you keep track of what you’re owed and what you’ve been paid. You may get multiple reconciliation reports, one from each bank you work with.

For cross-border payments: Reconciliation can be especially complex for businesses that receive funds in multiple currencies. To save time — and ensure accuracy in the process — it benefits you if your payment provider sends easy-to-read processing statements that consolidate all information related to transaction activity (countries, banks, currencies, etc.). Ideally, your payment provider should offer the option for a single consolidated report, which includes every transaction from every bank, currency and payment type.

How to Accept Cross-Border Payments

If you’re interested in being able to accept cross-border payments, with a minimum of hassle and fees, then there’s a few important things you’ll need to consider:

- Where your customers are located. This will dictate the languages that you’ll need to support as well as required compliance and taxes they may need to pay.

- How your customers will want to pay. You’ll need to be able to provide the currencies and payments that they’ll want to use

- Where your business is located. Leveraging all your legal entities can help you create the right connections to local financial institutions.

Processing cross-border payments has a lot of moving parts, and the more regions you serve, the more payment types you need to accept and the more banks you need to work with increases your payment complexities.

Thankfully, there’s a fourth consideration for accepting cross-border payments: Which payment provider will you choose?

Much of the process of cross-border payments can be handled by a payment service provider (PSP) that will manage the accepted currencies and payment options, automatically display appropriate languages, offer compliance to regulations and handle the gathering of payment details and reconciliation.

If you choose BlueSnap’s Global Payment Orchestration Platform, then you’re getting all of that and more. Our platform is designed to optimize cross-border transactions to increase your authorizations and reduce costs.

The Benefits of Optimized Cross-Border Payments

According to BigCommerce, merchants that sell to international customers boost sales by 10% to 15%. That’s because they have access to a much wider audience than those that only deal locally. Similarly, platforms that can onboard new clients in international markets expand their reach exponentially.

The catch? There’s a big difference between just accepting cross-border payments and optimizing them. Optimizing those payments means creating both an ideal experience for your customers and an ideal operational setup for your company.

To get the full benefits of selling globally, the key is to structure your payment processing strategy to increase sales and reduce costs.

Increasing Global Sales

When it comes to international payments, there are two levers for increasing sales: improving your authorization rate and reducing checkout abandonment.

According to our survey on cross-border payments, 40% of respondents report an international payment authorization rate of 70% or less. That means more than 30% of sales are lost after you’ve convinced a customer to choose your goods or services and then they go through the entire checkout process, submit their payment authorization, and then are denied the opportunity to purchase from you because the transaction is denied. You miss that sale and potential future sales from the customer.

But the right approach to cross-border payments can improve your authorization rate and lead to a 3% to 12% increase in sales. You need to:

- Match the customer’s country with the processing country

- Match the issuing bank with the acquiring bank

- Match the issuing currency to the acquiring currency

Additionally, you can see a 5% increase in sales by using the right retry logic and failover. Retry logic is about optimizing when and how the transaction data gets sent to the banks and is especially important for subscriptions. Failover, which is a capability that instantly reroutes declined transactions to another bank for approval, is essential because, without it, you are relying on one bank to process and authorize your transaction, which automatically limits your authorizations. You need to be able to rely on a network of banks – this way, if one bank does not process a transaction you can immediately failover to another bank in the same region.

BlueSnap Intelligent Payment Routing is a proprietary algorithm that routes transactions based on a number of critical factors to get you the highest likelihood of approval and increase your authorization rate.

Similarly, checkout abandonment is a significant challenge for those who sell cross-border. When it comes to reducing checkout abandonment, the biggest issue is local friction – 56% of companies do not offer global shoppers’ preferred payment methods, and 20% of shoppers will abandon checkout if it is not in their language.

To remove this friction, and reduce checkout abandonment, you need to offer a localized experience for your shoppers wherever they are. This builds trust and helps them fully understand their purchase, making them more likely to go through the entire process and increase your sales. Be sure to leverage your shoppers’ local languages, local currencies and local payment methods.

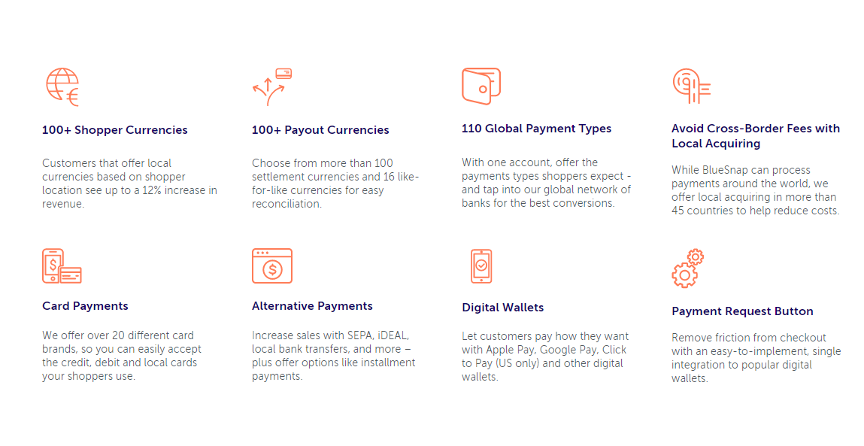

With 100+ local currencies, 110+ local payment types, including popular eWallets and 29 local languages, BlueSnap supports sales in more than 200 geographies.

Reducing the Costs Associated with Cross-Border Payments

The other side of profitability when it comes to selling cross-border is reducing the associated costs to improve your margins. This comes down to decreasing cross-border fees and reducing technical debt.

According to our survey, 68% of respondents are potentially paying unnecessary cross-border fees because they are processing payments where their business is headquartered rather than where their customer is located and they have a legal entity. Cross-border fees can add an additional 2% on top of the interchange fees you are already paying to process payments. You can avoid these fees by partnering with a payments provider that can offer local acquiring wherever you have a legal entity.

BlueSnap offers local acquiring in 47 countries to help you reduce avoidable cross-border fees.

Technical debt is another challenge businesses selling cross-border face. Our survey found that 31% of organizations are working with four or more payment processors to meet their cross-border needs. The amount of time and resources needed to integrate and maintain each platform can be crippling, not to mention making sure that they are meeting customers’ needs. Getting a holistic understanding of business performance is near impossible.

To combat technical debt, look for a global payment partner that can meet your needs everywhere you want to sell today and in the future. Look for unified global reporting to help you understand what is and isn’t working and how you want to allocate your global resources.

With BlueSnap, you get a single integration with everything you need to sell globally built in.

Reaping the Rewards of Optimized Cross-Border Payments

With these strategies in place, your business will enjoy a number of benefits, including:

- Increased ROI

By optimizing your cross-border payments, you’ll see a higher ROI on each transaction. By taking steps to lower the costs associated with each payment, you’ll be able to boost your margins.

That’s especially important because of the recently increasing card processing and interchange fees. Cross-border payments that process locally (for instance, a French credit card that processes in the EU rather than in the US) avoid many of these fees. The better your payment processor can minimize cross-border fees, the more ROI you’ll see.

- A Localized Global Customer Experience

If sellers don’t optimize their websites for cross-border payments, prospects likely won’t see their preferred language, currency or payment types – and this creates friction, leading to checkout abandonment.

On the other hand, if you design an eCommerce experience with cross-border payments in mind, you can offer the ultimate checkout experience for every shopper, particularly by incorporating localized payment types. By meeting your customers where they are, you can remove all possible obstacles to purchase and ensure that global customers enjoy an experience on par with domestic buyers.

For example, a shopper in Amsterdam who sees a checkout page in Dutch with prices and taxes calculated in euros and the option to pay with the popular Netherlands payment method iDEAL is far more likely to convert than a shopper who’s forced to operate within a US-centric payment experience.

- Operational Efficiency

Properly implemented cross-border payments are highly efficient and effective. For instance, processing cards locally helps transactions get authorized much more quickly. Similarly, a payment solution that optimizes payments by automatically adapting to a local region’s needs ensures you don’t lose transactions to false declines.

Centralizing your cross-border payments in one global payment processor also streamlines your internal operations. You no longer need to operate multiple accounts across regions or work with a net new provider in each region you enter. That means fewer issues with data, a single source for reconciliation and less manual work on integrations.

- Enhanced Reporting Capabilities for Reconciliation & Strategy

Reconciliation can often be a challenge when selling into multiple countries and using multiple payment providers to do so. It’s difficult to correlate data across those different solutions, causing you to struggle to compare insights from different markets. Different banks and payment providers each use their own terms and definitions that need to be interpreted and aligned. However, a single source of payment analytics creates a positive feedback loop of operational efficiency by helping you make more strategic decisions.

With a single global payments processor and accompanying reporting, you’ll be able to understand the impact of fees in different regions and take action to redress them. You’ll understand why payments don’t go through or what your fraud patterns truly look like in different countries. Not every cross-border payments tool comes with advanced reporting via one centralized account, but those that do help you grow more effectively and leverage rich data insights. At BlueSnap, we have synthesized the banks’ different terms into a common vernacular to make reconciliation easier and the data more useful.

- Fortified Payment Security to Prevent Fraud

Unlike domestic payments, cross-border payments must address numerous regions’ fraud patterns. A one-size-fits-all approach won’t work: fraud prevention must be optimized for cross-border or it risks missing new types of fraud as well as inadvertently denying transactions that aren’t fraudulent.

Processors designed for cross-border payments take regional idiosyncrasies into account to ensure your protection from regional fraud types while letting the right purchases go through. In London, 12 transactions coming through one IP address is a red flag for fraud that a processor should stop. In India, where many access the internet via cybercafés, 12 transactions from a single IP address is common and more likely to represent individual purchases.

When you get cross-border payments right and locally optimize payment processing, you unlock the door to many more rewards. This is key to growing your business — but you could still fall prey to some serious challenges.

Challenges with Cross-Border Payments

Cross-border commerce is experiencing unprecedented growth, and it’s projected to continue to expand. Yet only half of leading US retailers ship outside North America. Why have so few businesses capitalized on this opportunity? Because cross-border payments are:

- Subject to more regulations and can be slower and costlier than other payment types

- Harder to track and more likely to fail to process, causing the loss of legitimate sales

- Subject to cross-border fees, which results in two-thirds of merchants overpaying for cross-border transactions

- Seen as overly complicated or not worth the effort, leading to missed opportunities for maximizing revenue

Fortunately, leveraging the right payment APIs and technology can help reduce the pain points associated with cross-border payments and improve the end-to-end experience for customers.

See how the right optimizations can shift cross-border payments from a cost center to a profit center in our on-demand webinar Untapped Revenue Opportunities of Cross-Border Payments. Then read on for how BlueSnap simplifies the cross-border payment process.

Why Do Cross-Border Payments Fail?

Even when you meet all regional regulations, sometimes other issues are preventing your cross-border payments from delivering the results you want. How do you know when your approach is a failure? Here are some signs that indicate your cross-border payment service just isn’t cutting it:

- International shoppers abandon at a high rate

- Your payment success rate decreases among international shoppers

- You’re seeing higher-than-average refunds and chargebacks among international shoppers

- You’re not seeing a return on investment for your marketing dollars in a particular country (or countries)

Foreign transactions have a higher likelihood of failure than domestic ones simply because more factors come into play during the purchasing process. Following are the most common reasons why cross-border payments fail for eCommerce merchants and solutions for increasing your conversion rates.

1. Your checkout page isn’t in their language: Picture this: You’ve gotten numerous word-of-mouth recommendations for a type of video editing software made by a German company. You go to their website ready to buy, but since your German is a bit rusty, you can’t read the checkout page. You could try to navigate it, but how can you be sure you’re not missing out on key product or sales information? Rather than take a risk, you abandon the site — and the purchase.

That’s not an unusual scenario. People are prepared to buy from businesses halfway around the world as long as the transaction feels comfortable. If they can’t read the checkout page, that comfort level plummets. In fact, 75% of shoppers prefer not to make a purchase decision unless the site is presented in their native language.

Solution: Use a cross-border payment processing system that automatically detects a shopper’s IP address and serves up the payment page in the appropriate language. This tactic shouldn’t require any additional work on your part. BlueSnap’s payment gateway has the capability to display your checkout page in 29 languages — so no shopper is left behind. If you can make this fix, you’ve eliminated an obstacle and increased your chances of getting the sale.

2. Your checkout page doesn’t show prices in the shoppers’ local currency: Even if international shoppers can read your page, they may hesitate to click the “Buy” button if the purchase price isn’t displayed in their local currency. They’ll have to do the conversion calculations themselves, which adds friction to the checkout process; there may also be unexpected currency conversion fees that surprise the shopper, leading to chargebacks or refund requests. Plus, the transaction is less likely to be approved by an acquiring bank if the transaction is not processed in the currency in which the card was issued.

Solution: Similar to the foreign language fix above, your cross-border payment processing gateway should be able to automatically read the shopper’s IP and adjust purchase prices to the correct currency. Doing so will dramatically reduce friction in the checkout process and boost your chances that the acquiring bank will approve the transaction.

3. Your checkout process doesn’t support popular global payment methods: There’s no reason shoppers from any country should arrive at your checkout page and not see a familiar payment method. Shoppers will abandon the purchase if they don’t see a local payment option they prefer; or, at the very least, they’ll be less satisfied with the experience.

Solution: This is an easy fix — offer a localized payment experience that not only displays the right language and currency but also payment methods that are common in the shopper’s region. For example, a German shopper might prefer Sofort or Giropay, another from the Netherlands prefers iDEAL, and another from the UK wants to pay via SEPA Direct Debit. Make sure your cross-border payment system supports numerous international payment methods. (At BlueSnap we support more than 110 trusted payment types from all over the world.)

As many as 60% of shoppers abandon a purchase at checkout when they run into any one of the above frictions. If your customers have experienced any or all of them, then it’s likely that your current cross-border payment processing system is failing you.

BlueSnap’s Global Payment Orchestration Platform is designed to increase global sales by reducing checkout abandonment and improving authorization rates. When our platform routes a transaction, we identify where the card is from and then route it to a local bank in accordance with card rules, increasing the authorization rate by up to 6%. If a business with $50 million in cross-border transactions sees its authorization rates increase by 5%, that’s $2.5 million in incremental revenue.

4. Card transactions aren’t processed by a local acquirer: As part of every card purchase, customers’ debit or credit card information is passed along with an authorization request to an acquiring bank — an institution that processes card payments on your behalf. Most payment gateways partner with a single acquiring bank within their own country — an arrangement that sets international transactions up for failure. Why? Because transactions that are seen as foreign have a higher probability of being flagged for fraud.

Solution: Make sure your cross-border payment system uses numerous acquiring banks around the globe. A gateway with multiple acquiring bank partners will send your German shopper’s credit card approval request to a bank in the EU, which will see it as a local transaction and approve it. This type of intelligent routing to the right acquiring bank increases the payment success rate for transactions as they will not be processed as cross-border.

5. Your shipping and tax amounts aren’t clearly communicated: If your checkout page doesn’t clearly convey taxes or shipping costs, you could be losing business from international shoppers. Shoppers often abandon purchases if the shipping cost is more than expected; the same is true for taxes. Even worse, some merchants erroneously charge shoppers for taxes they don’t owe.

Solution: Clearly communicate your shopping policy and costs at checkout. Consider providing a tool at the beginning of the checkout process so that shoppers can find out if you ship to their country and what the costs will be. When it comes to collecting taxes, companies like Avalara, a BlueSnap partner, can help you determine how much, if any, taxes should be collected. Shoppers may abandon the purchase if they think they are paying taxes not required in their country or region.

What Are Cross-Border Payment Regulations?

The more regions in which you choose to do business, the more regulations you need to consider to ensure you’re protecting yourself and your customers from fraud, while also avoiding fines and lawsuits. We’ve identified six key regulatory categories as well as some important examples:

1. Payment network policies: These include any rules, regulations, guidelines or specifications put forth by payment networks, including EFT networks and Credit Card Associations. Payment networks can (and definitely will) penalize and fine merchants for not following established policies.

Network policies to which you must adhere include proper display of payment brands, specific transaction receipt data requirements and clear disclosure of return and refund policies.

2. Data privacy: Different regions have established different regulations over the handling of personal data, which is broadly defined and typically includes information like an individual’s name, email, location, online identifier, IP address, home address, etc., whether in a work or domestic setting. These regulations cover the rights given to individual data subjects concerning the personal data being stored, including the right to prior notification of what the data is being used for, how it will be processed and when it will be deleted.

Depending on the region you operate in, you’ll need to comply with certain data privacy regulations. The California Consumer Privacy Act (CCPA), for example, provides California consumers with specific privacy rights over their personal information. Any merchants covered by the CCPA will need to explain how personal data is managed and allow consumers the ability to submit requests exercising their statutory rights.

Business done in Europe falls under the scope of the General Data Protection Regulation (GDPR), a regulation in place across the European Economic Area (EEA) that increases the level of control that EEA and UK citizens/residents have over their personal data and presents a more unified environment for international business across Europe.

3. Consumer security: New payment technology requires new payment security, so different regions have enacted regulations to protect consumers from fraud and theft. One of the more impactful security measures is the Revised Directive on Payment Services (PSD2), enacted by the European Parliament to better protect consumers as they pay online. PSD2 is one of the EU’s most important regulations for merchants to consider as it requires Strong Customer Authentication (SCA) via three levels of identification for every transaction, from card number confirmations to texts with authorization codes.

PSD2 and SCA apply to online payments that go through the European Economic Area (EEA) or the UK in any capacity. If you’re a European merchant and not PSD2 compliant, then any payments processed through the EEA could be declined — so you need a payment processor offering features like 3-D Secure that enable PSD2 compliance.

4. Payment Card Industry Data Security Standards: Payment Card Industry (PCI) is a Data Security Standard (DSS), which is a set of requirements established by the major card companies to ensure that all businesses that process, store and/or transmit credit and debit card information maintain a secure environment. These standards help to defend against cyber-attacks, data hacks and other security breaches, which can result in extensive costs associated with loss of business, credit monitoring, post-breach audits and security updates.

5. Tax collection: Tax responsibilities for businesses depend on a variety of factors such as the sales revenue, transaction volume and the location in which sales occur. In addition to the specific local tax laws, the payment model under which you operate also has an impact.

For example, in June 2018, the US Supreme Court ruled in South Dakota v. Wayfair, Inc. that US states are allowed to tax remote sales even if the business has no in-state presence. Prior to the ruling, states could only tax sales by businesses that had a physical presence within the state. Now, the economic nexus (economic activity in a state based only on sales revenue, transaction volume or a combination of both) can result in a sales tax obligation if the nexus is above a certain threshold.

6. IT security: The threat of cyber-attacks and data breaches increasingly put businesses at risk of costly harm from data theft, ransomware attacks and damage to reputation. To ensure that businesses are protected against hackers, cybersecurity regulations have been drafted to cover elements including data center redundancy, data storage, data recovery and other security investments. Some regulations, such as the National Institute of Standards and Technology (NIST), are voluntary, while consume security protections like the Colorado Privacy Act, the California Consumer Privacy Act and New York’s SHIELD Act apply to any company that does business with a state’s residents and meets specific criteria.

Payment regulations vary depending on a transaction’s location and payment method. And for cross-border payments, your payment provider must understand them for every region around the world. For example, 3-D Secure 2 is a global specification designed to satisfy the PSD2 mandate for SCA. It is an advanced authentication solution that reduces fraud by identifying a cardholder’s identity in real time, helping to prevent the unauthorized use of cards and protecting the seller from fraud.

If you’re a business in the EU or UK, it’s easy to ensure that you’re compliant with PSD2 regulations when your payment provider offers built-in, out-of-the-box support for integrating 3-D Secure. BlueSnap’s Payment API provides support for 3-D Secure 2, PCI Compliance and other regional regulations. When you’re looking to optimize cross-border transactions, the easiest way to know that you are properly managing all tax and regulations issues is to work with a payments partner that understands them.

What Is a Cross-Border Fee?

Processing card payments comes with associated fees, sometimes called a cross-border assessment fee. When you process cross-border card payments, additional fees are charged on top of them – usually adding up to an additional 2% to each cross-border transaction. These additional cross-border fees are fixed, non-negotiable and set by card networks.

History of Cross-Border Fees

Prior to 2005, cross-border fees did not exist. Instead, card processing companies charged currency conversion fees to cover the costs of international transactions. Some merchants found a way around the conversion fees, usually by using a bank that supported multi-currency processing or by having distributors in different countries. To combat these workarounds, the card companies instituted the cross-border fee to account for any and all international card payments, regardless of whether a currency conversion was needed.

When Might a Cross-Border Fee Apply?

Whenever someone buys your goods or services using a card, you pay a card processing fee. The majority of the fee, which varies by type of cards, is the interchange fee.

When the customer uses a card issued in a different country or region from where the payment is processed there may be an additional cost for a cross-border interchange fee that is added on top of the regular interchange fee.

For example, a US online business sells a $100 item to a shopper in France who pays with a Visa card issued in France. The business will pay up to 2% in incremental fees for that order if they process the transaction in the US.

It is the card networks themselves that define what is and is not cross-border. For example, that same French shopper purchasing from an Italian online retailer with the same card would not be considered cross-border. For the purposes of card payments, Visa considers Italy and France to be in the same region (EU).

Even if you avoid cross-border interchange fees, your business or your customers still might have to pay a foreign exchange fee:

- If the French shopper pays in US dollars, they will have to pay the foreign exchange fee, which will raise the overall cost of the purchase and may discourage future sales.

- If the French shopper pays in Euros, then the US business is charged a foreign exchange fee in US dollars, which is costing the business money.

Why Cross Border-Fees Are Passed to You

- At least 54% of American shoppers reported making an online purchase from a foreign site, and eCommerce totals are expected to reach at least $1 trillion in 2020. Approximately 67% of shoppers spent 10% or more of their monthly online spending toward cross-border commerce. As companies ramp up cross-border sales, the card networks see a good opportunity to increase their own revenue.

- As cross-border commerce rises, banks that issue cards face a higher risk of fraud. The Nilson report states that global card fraud losses will exceed $35 billion by the end of 2020. Cross-border sales, and Card Not Present (CNP) transactions in general, are especially hard to verify. The increased cross-border interchange fees help banks cover the risks.

- Some countries have placed a hard cap on card processing fees, so the card networks have looked for other ways to grow revenue. In the European Union for Card Not Present transactions, the interchange rate is capped at 1.15% for debit cards and 1.50% for credit cards. Other countries, including Australia and the US, have caps to protect businesses in their jurisdictions.

However, there are no caps on cross-border interchange fees. And there are no business councils or governing bodies that advocate for cross-border merchants. So, the card networks have the latitude to change those fees. To be clear, they are often justified in doing so. But there tends to be no dialogue about it or regulatory oversight for it.

How Much Are Cross-Border Fees?

The exact cost of fees will depend on where in the world your business is based, and the currency used for the transaction. However, cross-border fees can add an additional 2% on top of the fees already required for processing payments.

More recently, following the United Kingdom’s withdrawal from the EU (Brexit), Visa and Mastercard are increasing fees on those transactions being processed between the two economic regions.

BlueSnap CEO Ralph Dangelmaier puts it this way:

“Consider the real price of up to a 2% increase in fees for an online retailer: If an eCommerce store sells $200 million worth of goods and 25% of its sales are considered cross-border, then $50 million of that revenue is subject to the cross-border interchange fee, meaning they are paying, on average, up to $1,000,000 in fees that could be avoided.”

Is There a Way to Avoid Cross-Border Fees?

Yes, unnecessary cross-border fees and foreign transaction fees can be avoided.

When you use a payment provider that’s partnered with numerous acquiring banks around the world, payments can be routed based on card brand rules to banks more likely to approve them — such as those within the card’s issuing country or region — in addition to using the right currency to help you avoid additional fees.

Here are the full details on how BlueSnap’s All-in-One Payment Platform helps you increase sales and reduce costs through local acquiring and local currencies.

Local Acquiring

ECommerce sellers can avoid cross-border fees with the right connections to local banks in each geography they have a local entity in, so they can benefit from local acquiring. Local acquiring is when the seller’s acquiring bank and the shopper’s issuing bank are both in the same region or country. When the banks are in different regions, cross-border transactions are more likely to be declined because of the higher rates of fraud in cross-border transactions, and they often incur hefty fees that could be avoided.

When your payment provider can easily route a payment to an acquiring bank in the same region as the issuing bank, that’s local acquiring.

To process a transaction locally, businesses need to have a legal entity in that region. The more online global business a website does, the more connections to local banks they need. On average, international businesses use five different payment gateways to route cross-border transactions to local banks.

Fortunately, you don’t have to handle multiple payment providers or take on a high amount of tech debt to expand your local acquiring capabilities. With BlueSnap’s All-in-One Payment Platform you get access to our network of global banks for local acquiring in 47 countries. Additionally, BlueSnap’s platform is built for global growth and includes the local currencies, various payment types, like eWallets, and fraud prevention needed for payment optimization.

Local Currencies

Online businesses might also see foreign exchange fees when customers pay in one currency but then the banks pay you out in another. Again, BlueSnap can help. We enable you to accept 100 shopper currencies, so your customers don’t need to pay foreign exchange fees.

We also settle payments in 16 different like-for-like currencies, which is useful to keep the funds in the local currency and avoid exchange fees if you operate your business in multiple countries or run an online marketplace with merchants dispersed around the world. We provide support for not only the countries that you’re operating in now, but we can also ensure that your future international growth is as seamless as possible.

When you are able to process cross-border payments as if they were local, leveraging quality banks and intelligent payment routing, your sales increase and you can reduce your costs.

How BlueSnap Simplifies Cross-Border Payments

Here at BlueSnap, we’re committed to helping you grow your cross-border sales through thoughtful solutions that take the complexity out of payments. With a single connection to our Global Payment Orchestration Platform, you have everything you need to increase international sales and reduce costs.

The Best Cross-Border Payments Solution, Hands Down

- BlueSnap vs. Banks

If you’re processing cross-border payments via banks, you need to form a relationship and obtain a merchant account with a new bank in every region you enter, and then build a separate integration to each bank. That means much more work on your end, without the ease of a centralized integration.

With BlueSnap, you gain immediate access to one of the largest networks of acquiring banks anywhere — through one account and one integration.

- BlueSnap vs. Processors Like Stripe

When it comes to cross-border payments, BlueSnap’s platform dramatically outperforms competitors like Stripe and Braintree for one simple reason: you gain all of these benefits and can process payments in every corner of the world. With BlueSnap’s Glboal Payment Orchestration Platform, through one account and one integration you get a network of banks for routing and failover.

Other solutions require you to set up separate accounts and integrations for every region in order to benefit from local payment processing. BlueSnap’s single integration has everything you need for cross-border payments built in, including local bank relationships, local payment types, local currencies and more.

- BlueSnap vs. Everyone Else

With a network of more than 30 quality banks worldwide, BlueSnap is one of the only payment processors that can automatically route cross-border transactions to a local acquiring bank following card network rules. Our smart technology considers key transaction attributes, including card type, where it was issued, the currency, and the amount. Based on that information, we then employ our proprietary Intelligent Payment Routing to route the transaction to a bank that will regard it as a local transaction, effectively allowing us to localize almost any payment and increase conversions.

Experienced in All Types of Cross-Border Transactions

BlueSnap’s global payment solution handles all compliance and regulation needs for you. By choosing BlueSnap, you gain a partner that specializes in cross-border transactions, with the ability to advise on payment optimization or even help you set up a legal entity in a new region.

Want more insights and strategies on how you can take advantage of cross-border opportunities? Watch our on-demand “Cross-Border Payments & Coffee” Webinar to see how your global eCommerce business can thrive.

Cross-Border Payment Success Stories

Outbrain Case Study

Benevity Case Study

DFO Global Case Study

Find out more about our global payment solutions, or contact us to learn more about how a single integration to BlueSnap gives you everything you need to sell globally built in.

Ready to optimize your cross-border payments?

1 Oberlo – 19 Powerful eCommerce Statistics That Will Guide Your Strategy In 2021

2 Digital Commerce 360 – Pandemic Prompts The World’s Online Shoppers To Buy More Cross-Border

3 Forrester – Forrester Data: Online Cross-Border Retail Forecast, 2017 To 2022 (Global)

5 Boston Consulting Group – An Interactive Guide to Global Payments

6 Tool Tester – Stay in The Online Retail Loop – 21 Ecommerce Statistics to Know in 2021

Streamline your payment solution and gain functionality.

Frequently Asked Questions

What are cross-border payments?

Cross-border payments, or cross-border transactions, occur when the acquiring bank and the issuing bank are in different regions. When banks process cross-border payments, they perceive them to be riskier than domestic transactions, leading to higher fees and a greater likelihood of being declined.

How are B2B cross-border payments different from B2C?

As international commerce grows, B2B cross-border payments are increasingly important as B2C payments, but functionally they often lag behind B2C payments in terms of customer experience, transaction speed, amount of manual effort required and more. B2B companies can close that gap, and see a 25% uptick in conversion rates, by choosing a payment processor optimized for cross-border transactions.

What are the different types of cross-border payments?

Cross-border payments can take any of the same forms as domestic payments, from eWallets and card payments to bank transfers. It’s important to be able to accept all types of payments, including payment types native to particular countries you sell in. That way, customers from around the world find it easy to pay. Shoppers in different countries also have different purchasing habits, such as on mobile vs. laptop. The more you tailor the experience to your customers’ locations and preferences, the more you will sell.

What is BlueSnap?

BlueSnap helps businesses accept global payments a better way. Our All-in-One Payment Orchestration Platform is designed to increase sales and reduce costs for all businesses accepting payments.

BlueSnap supports payments across all geographies through multiple sales channels such as online and mobile sales, marketplaces, subscriptions, invoice payments and manual orders through a virtual terminal.

And for businesses looking for embedded payments, we offer white-labeled payments for platforms with automated underwriting and onboarding that supports marketplaces and split payments.

With one integration and contract, businesses can sell in over 200 geographies with access to local acquiring in 45+ countries, 110+ currencies and 100+ global payment types, including popular eWallets, automated accounts receivable, world-class fraud protection and chargeback management, built-in solutions for regulation and tax compliance, and unified global reporting to help businesses grow.

Who can use BlueSnap?

Merchants around the world can use BlueSnap to accept payments in 200 geographies with BlueSnap local acquiring in 47.

How do I integrate with BlueSnap?

We have flexible integration options that work for web and mobile. If you are building your own custom payment pages or apps, you can use our APIs, hosted payment fields and/or hosted payment pages. And with integrations to the software platforms and shopping carts you already use, you can start processing payments immediately. Learn more here.