Here at BlueSnap, we understand how important fraud prevention is for your eCommerce site. That’s why we have partnered with Kount, a leader in fraud detection and sales boosting technology, to help you quickly and easily integrate fraud protection services for your business.

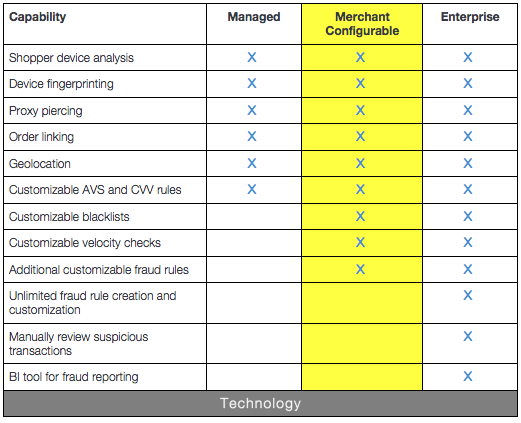

We have three levels of fraud prevention that you can choose from: Managed (no customization), Merchant Configurable (some customization), and Enterprise (completely customizable). Let’s examine how Merchant Configurable can help you customize your eCommerce fraud prevention to work for your business.

Merchant Configurable is the second degree of fraud prevention services that we offer, which provides more opportunities for customizations than our base-level fraud prevention (Managed). Merchant Configurable is ideal for merchants that need an additional layer of protection that can be easily implemented in a simple user interface. The Merchant Configurable fraud prevention service provides a set of thresholds, in addition to the AVS and CVV rules, that you can enable and customize to match your specific business model. With added customizations, Merchant Configurable allows you to create rules that will help decrease fraud and increase your bottom line.

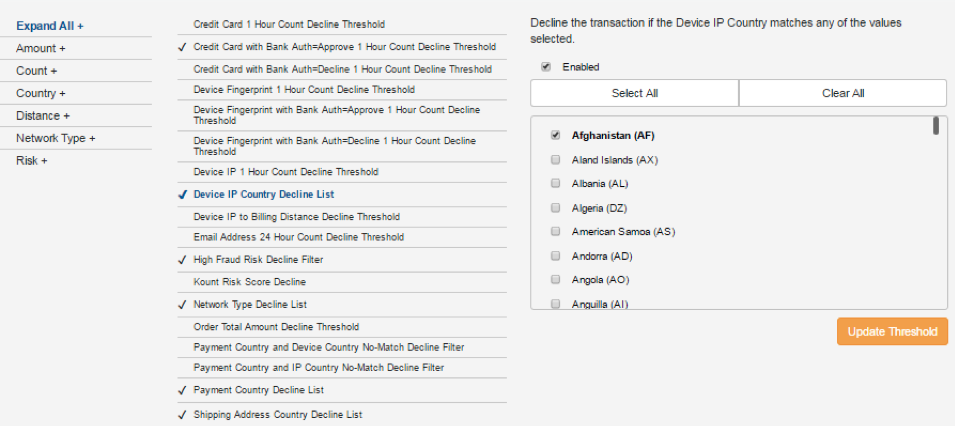

With Merchant Configurable, you receive all of the Managed features, plus 18 key fraud rules that can be managed in our merchant portal. You can also use our Stopped Fraud report to track all orders that were declined based on one of your customized rules (fraud threshold, AVS, CVV rules, etc.).

Here is an example of how Merchant Configurable fraud prevention could be used for your business:

The checkboxes indicate that a rule is enabled. In the example above, the highlighted rule is Device IP Country Decline List. This rule will decline transactions whenever the shopper’s device IP address is located in the list. You could use this rule if, for example, you were having a lot of chargebacks from a particular country such as Afghanistan. Declining the transaction based on the device IP location guarantees that you can stop all orders when the shopper is in Afghanistan, even if they are using a stolen card that is issued in the U.S. or some other country.

Fraudsters often use proxy networks to conceal their true IP location, making it appear as though they are located in a country where their stolen credit card was issued. Importantly, with Kount’s technology, we are able to detect when a shopper is using a proxy to conceal their true IP location. This rule would still decline an order even if the shopper in Afghanistan was using a proxy to make it appear as though they were located in a different country.

By using this functionality, you are able to prevent potential fraud from getting through on your site that could have gone through without these customizable rules.

If you want to learn more about how Merchant Configurable can help you, sign up for the on-demand webinar, How Customizing Your Fraud Prevention Can Increase Your Bottom Line, with Kount.

Watch Now