Grow International Sales with Optimized Cross-Border Payments

Global Sales Should Create Business Opportunities, Not Challenges

As a global business, you know cross-border payments, or card payments from issuing banks in one region being processed by an acquiring bank in another, are complex. Different geographies involve different currencies, regulations and payment types, often leading to multiple software integrations just to accept the payments.

Additionally, cross-border payments can suffer from higher costs, lower authorization rates and increased checkout abandonment.

But BlueSnap’s Global Payment Orchestration Platform offers a better way to process cross-border payments so you can get a better ROI.

200

billion dollars spent annually on transaction and FX fees for cross-border payments. With BlueSnap’s approach to cross-border payment processing, you can reduce your fees and improve your authorization rate.

Cross-Border Fees: Are They Necessary?

Card brands charge businesses up to an additional 2% in cross-border fees on top of the standard interchange fees due to the perception that cross-border payments are high-risk. BlueSnap helps businesses avoid unnecessary fees by processing cross-border payments as if they were local whenever possible, in accordance to card brand rules. With the Payment Orchestration Platform, we are able to leverage our global network of banks, local currencies and payment methods, and more all to reduce your costs when selling internationally.

Boost Your ROI with BlueSnap’s Cross-Border Payment Processing

Reduce Cross-Border Fees

Improve Auth Rates

Increase Revenue

Eliminate Technical Debt

A Single Integration with Everything You Need to Sell Globally

Growing your global business requires having the ability to optimize customer conversions while reducing costs. BlueSnap provides the ability to sell into over 200 regions with local card acquiring in 47 countries to help you increase revenue while avoiding unnecessary fees. Our proprietary Intelligent Payment Routing improves your authorization rate and you get access to 100+ currencies and 100+ payment methods – all through one connection to BlueSnap’s Payment Orchestration Platform.

Features

Local Card Acquiring

Increase transactions and reduce costs by selling to 200 regions with local card acquiring in 47 countries and Intelligent Payment Routing for higher authorization rates.

Intelligent Payment Routing

BlueSnap ensures successful conversions by routing payments to get the highest approval rate – with automatic retries when necessary.

Local Currencies & Payments

Localize the payment experience for your customers with the ability to accept 100+ currencies and 100+ payment types with a single integration.

Simple Reconciliation & Payout

Consolidate multi-currency reconciliation for easier reporting. We can pay you out in the currency you choose – 18 like-for-like.

Avoid Cross-Border Fees with Local Card Acquiring

While BlueSnap can process global payments in over 200 geographies around the world, we offer local card acquiring in 47 countries to help you increase authorization rates and reduce costs.

Local Card Acquiring Is Available in the Following Geographies:

Argentina

Australia

Austria

Belgium

Brazil

Bulgaria

Canada

Chile

Colombia

Croatia

Cyprus

Czech Republic

Denmark

Estonia

Faroe Islands

Finland

France

Germany

Gibraltor

Greece

Guernsey

Hungary

Iceland

India

Ireland

Israel

Italy

Latvia

Liechtenstein

Lithuania

Luxembourg

Malta

Mexico

Netherlands

Norway

Poland

Portugal

Romania

Slovakia

Slovenia

Spain

Sweden

Switzerland

United Kingdom

United States

Speak with a Payments Expert

At BlueSnap, we know payments. We’d love to help you strategize about how your business can get the most out of payments.

Intelligent Payment Routing for Global Revenue Growth

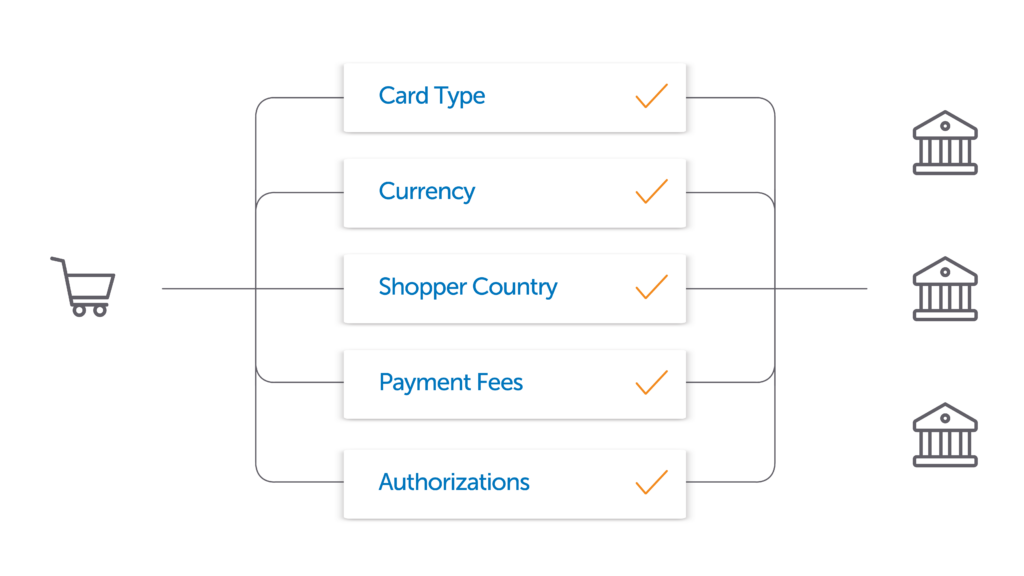

With BlueSnap’s Intelligent Payment Routing, our processing engine automatically analyzes buyer characteristics – such as currency, issuing country and payment type – to route the payment to the bank most likely to approve that specific transaction. This minimizes declines and maximizes revenue gains, growing your sales.