We are excited to begin our support for Apple Pay in Safari and native iOS apps. In this post, I’ll delve into Apple Pay in Safari and look at some of the unique benefits of offering Apple Pay on your website. (Don’t worry, instructions for using Apple Pay in iOS apps are covered in our documentation.) After reading this article, check out our detailed documentation to understand how to implement Apple Pay for yourself, so you can start taking advantage of these benefits!

How does Apple Pay work?

Apple Pay provides shoppers with a simple, secure way to pay for products and services with their credit, debit, and prepaid cards. It works with many major card brands, including MasterCard, Visa, Discover, and American Express. Shoppers’ cards are linked to their supported Apple device in the Apple Pay wallet app.

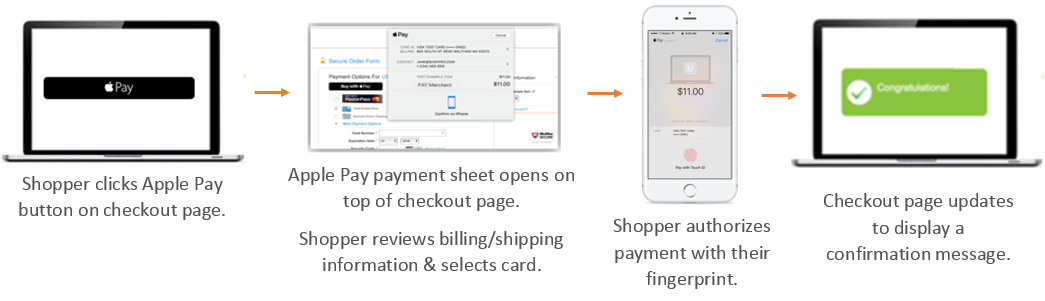

Here’s what the process looks like for customers:

The Benefits Of Apple Pay

High Availability

Apple Pay is accessible in Safari from a variety of supported devices. For mobile web purchases, shoppers can use iPhones running iOS 10+ to authorize the payment via Touch ID. For desktop web purchases, shoppers may either use a MacBook Pro with Touch ID or use a Mac model 2012 or later paired with a supported iPhone or Apple Watch (the above image reflects this process).

This cross-device accessibility means shoppers can use their favorite device(s) to make purchases and access their preferred payment method every time, increasing the number of avenues for you to make a sale.

Enhanced Security

Apple Pay optimizes checkout security in two primary ways:

- The tokenization of sensitive card data. When the shopper adds a card to their Apple Pay wallet, the information is encrypted immediately and stored on a Secure Element inside the device to prevent unauthorized access. Additionally, every transaction is assigned a unique token to further reduce risk of data theft. Raw card data is never stored or shared by Apple, you, or BlueSnap—it is only ever referenced by the encrypted token. Shoppers can be confident that their payment information is safe and secure.

- The merchant validation process. Every time a shopper clicks the “Buy With Apple Pay” button, Apple first verifies that you are a valid merchant that is authorized to accept Apple Pay. This merchant validation process acts as a gatekeeper for every purchase transaction, boosting the level of security even more.

Frictionless Checkout

Since Apple Pay eliminates the need for shoppers to enter shipping, billing, and payment information, the checkout experience is simple and streamlined. This information is only entered once—when the shopper first adds their credit card to their wallet app. For all transactions thereafter, the tokenized data is used to complete the payment. All shoppers have to do is review the purchase order and authorize it with their fingerprint.

And don’t worry about creating confusion on the part of the shopper: Customers are only shown the Apple Pay button if they are using a supported Safari browser and have a device compatible with Apple Pay.

Put it all together—accessibility, security, and frictionless checkout—and you can expect conversion rates significantly higher than those associated with traditional credit card checkout. Apple Pay for websites works for whatever you sell—physical or digital goods, subscriptions, and more—and is a simpler, easier way to handle online checkout, invoice payments, and even marketplace payments.

Ready to get started?

For more information on Apple Pay integration, check out our documentation:

- Visit our Developer Hub to enable Apple Pay with your API integration.

- Go to our Help & Support section to enable Apple Pay with your BuyNow page integration.