Many factors are needed to make a customer’s buying process frictionless. One behind-the-scenes factor that often gets overlooked is how to determine whether the payment will be accepted or declined — and how to help it succeed. The key to shifting your transaction approval rates in your favor lies in Intelligent Payment Routing, which means routing the transaction in a way that is most likely to be approved.

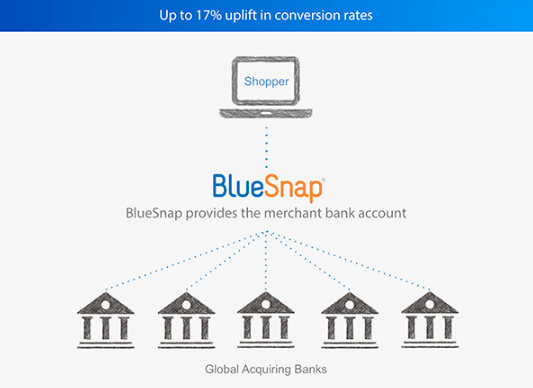

Most payment providers are either connected to one acquiring bank in a region or require merchants to obtain their own acquiring merchant account in each region. By connecting our merchants to a global network of acquirers and providing the merchant accounts necessary, the BlueSnap’s Payment Orchestration Platform is designed to get you the best payment authorization rates using our proprietary global Intelligent Payment Routing.

What Is Intelligent Payment Routing?

Benefits of Intelligent Payment Routing

Common Challenges & Potential Pitfalls of Intelligent Payment Routing

Transform Your Business with BlueSnap’s Global Intelligent Payment Routing

The Payment Routing Evolution Model

Intelligent Payment Routing FAQs

What Is Intelligent Payment Routing?

Payment routing is the process of directing a payment transaction through a bank or service provider. While many payment service providers can only route transactions through a single, specific acquiring bank, it can cause problems when the route becomes unavailable or there’s an issue with the transaction.

When payment service providers have access to multiple acquiring banks, they have more options for routing payments. Intelligent Payment Routing makes use of AI and detailed payment analytics to consider multiple variables about a transaction before determining which bank has the highest likelihood of approval. It is the most flexible and adaptable means of routing payments.

How Intelligent Payment Routing Works

Some aspects of Intelligent Payment Routing process start with the details of the individual business. The payment gateway routing software considers where the business is located, its provided products or services, the most common payment types used and into which countries the business is selling. Based on that information, an array of global acquiring banks are determined.

Then, when a customer makes a purchase on that company’s website, our flexible, intelligent payment processing engine quickly reviews relevant factors such as the region where the customer is located, the currency being used to pay, the amount, the type of card and other details, and routes the transaction to the acquiring bank that has the highest likelihood of getting the transaction approved.

Benefits of Intelligent Payment Routing

While the specifics of how Intelligent Payment Routing works varies with each transaction, it offers the following benefits:

- Increased Authorization Rates & Increased Revenue: By routing every transaction to the bank that offers the highest authorization rates for such types of transactions, you can significantly increase your authorization rates. Intelligent Payment Routing services can provide additional features for supporting transactions, such as “failover transactions.” Failover is when one bank declines a transaction, and then it is immediately re-routed to another bank to approve it. In doing so, a business can increase its percentage of approved transactions, and the money it is bringing in.

- Improved Customer Experience: The more work a potential customer has to put into making a payment, the more likely they are to abandon the process and shop elsewhere. By increasing the likelihood that each transaction will succeed, Intelligent Payment Routing helps to make the checkout process frictionless.

- Reduced Transaction Costs: By routing transactions in the best way possible, companies can reduce unnecessary fees, like those often associated with cross-border payments.

- Better Insights Through Data: The large amount of payment routing data gathered through Intelligent Payment Routing can also power payment analytics. Companies can use these analytics to help identify further improvements for payment success. For example:

- Is the checkout page set up correctly to capture the shopper’s currency?

- Are price points and subscription plans influencing your conversions?

- Which banks are resulting in more failovers?

When you combine all of these benefits, it is clear that Intelligent Payment Routing can have a better impact on a business’s bottom line.

Common Challenges & Potential Pitfalls of Intelligent Payment Routing

To be done well, Intelligent Payment Routing requires expertise, investment and innovative technology. Three major challenges emerge when developing and operating your own solution: complexity, scalability and security.

Here’s how BlueSnap’s propriety Intelligent Payment Routing technology addresses these areas to help our clients optimize their transaction success.

We Solve for Complexity

Intelligent routing vastly increases the complexity of all payment-related processes. When you connect with multiple payment service providers to implement your own intelligent routing, you need to consider all their variables, from the fees they charge to their data settings to their reporting format. This requires developing a logic that can review vast amounts of data to immediately deploy which transaction to route to which processor based on established criteria.

When Outbrain, a content discovery and native advertising platform, wanted to improve its payment authorizations, it needed a technology that could handle the complexities of global reach. Not only was our unique approach to payment optimization key in improving authorizations, but our approach also helped to eliminate cross-border fees, saving Outbrain thousands of dollars each month.

We Manage Scalability

Any business needs to consider how to manage and scale payment volume, especially as it expands globally. Connecting to an established global network of banks and implementing the correct routing to them provides the best results.

As DFO Global, an international marketing and eCommerce company, looked to move into new markets and scale their businesses, they needed payment routing technology that could adequately support them. They chose BlueSnap for our propriety Intelligent Payment Routing solution that automatically routes every transaction through the most appropriate bank based on payment conversion intelligence via billions of optimized, global transactions. This approach means more authorized transactions and lower fees for international payments.

We Oversee Transaction Security

Beyond making sure that transactions are approved, it’s important to know they’re secure and resistant to fraud. Every transaction should be routed through a fraud-detection engine and must be compliant with all PCI standards. In addition to Intelligent Payment Routing, our Payment Orchestration Platform has world-class fraud prevention technology from Kount, an Equifax company built in.

As a result, companies like Arbonne, a multinational cosmetics company, are able to enjoy fraud protection that adapts to regional challenges and regulations, resulting in reduced chargeback rates, faster interception of fraudulent charge attempts and fewer legitimate transactions being inaccurately prevented. The powerful combination of Intelligent Payment Routing and with the right level of fraud prevention saves companies time and money.

Transform Your Business with BlueSnap’s Global Intelligent Payment Routing

All businesses are looking to increase their payment conversions and often struggle with the best ways to do so. Our Intelligent Payment Routing is one way we help businesses optimize their payments. Our proprietary logic and network of global banks, combined with the full strength of our Payment Orchestration Platform set BlueSnap apart.

First, we board you to the right acquiring banks based on your company’s specific characteristics. Then, when a customer submits payment on your website checkout, we route the transaction using a variety of factors to optimize payment approval. If for some reason the transaction fails, it is automatically rerouted in real-time.

If any decline is due to outdated card information, we send the card for an update via our Account Updater feature and retry the transaction when we receive the updated information. All of these retries happen in real-time and are completely invisible to the shopper.

Plus, we have a team dedicated to monitoring your transactions and overseeing your success rates. When issues arise, we’ll review your data to see what’s causing the matters and then make necessary adjustments. Our payment analytics and reporting also give you a full view into all transactions through one convenient source with multiple options for getting the exact information you want. Our reporting is highly customizable to focus on the fields that are most relevant to you, for better business insights and easier reconciliation.

All of this means more control over your payments. Don’t miss out on the revenue that Intelligent Payment Routing can save for your business, see what our Payment Orchestration platform can do for your business.

The Payment Routing Evolution Model

A company’s need for payment routing will evolve over its lifecycle. While larger enterprises may skip a step, here’s a representation of how payment routing matures alongside a business’s growth. Keep in mind, however, that businesses at any stage would benefit from Intelligent Payment Routing.

Step 1: Single Acquiring Bank

Most businesses will start with a single acquiring bank, as it’s the quickest and easiest payment process to set up. Though uncomplicated, because it has a single route, this model is the most susceptible to failures whenever there’s an issue with a transaction or the acquiring bank. It is also limited in the number of regional areas it can accept payments from, being mostly limited to domestic transactions.

Step 2: Multiple Acquiring Banks

As a business grows to accept more transactions from more customers — with some being from other countries — the risk of failure grows. To continue to accept this influx of different payment methods, the business will need to expand to use multiple providers. These might be different banks within the same region or located in other countries.

At this stage, the routing is likely static — manually configured and always the same based on certain criteria. For example, all transactions in North America use one provider, while transactions in Latin America use another. This model is unresponsive to changes and disruptions, and still suffers from higher failure rates.

Step 3: Intelligent Payment Routing

Businesses that need to use as many acquiring banks as possible and want to ensure the highest possible success rate will move to take advantage of Intelligent Payment Routing. This improves on the multiple bank model by dynamically routing transactions based on certain criteria such as card type and payment currency.

Intelligent Payment Routing is the most complex step and requires establishing relationships with hundreds of banks across dozens of countries, developing powerful algorithms that can process large amounts of data and redirect payments in real-time, and implementing security measures that guarantee all transactions are legitimate and protected.

Intelligent Payment Routing FAQs

How does Intelligent Payment Routing work?

As soon as a customer submits payment, after going through fraud checks, a payment service provider with Intelligent Payment Routing will consider all the transaction’s applicable criteria. The technology will instantly determine which acquiring bank has the highest possible success rate and will route the transaction appropriately.

What is failover?

Failover is when a transaction is routed to another bank after it is initially declined. When a payment processor is connected to multiple banks within a region, depending on the decline code, it can immediately send that transaction to another bank in real time for approval.

What’s the difference between traditional payment routing and Intelligent Payment Routing?

Traditional payment routing is a static process that connects to a single, regional acquiring bank. Even larger businesses that have access to multiple acquiring banks are limited by traditional payment routing as it always follows the same logic for every transaction. This can result in a higher number of declines.

Smart or Intelligent Payment Routing addresses these issues by identifying the most efficient route between available banks. It sends transactions for approval in the most optimal manner based on selected parameters. It is an essential payment processing feature for any business.

Related Resources:

- Improve Your B2C Online Business with the Right Payment Solution

- Merchant Account vs. Payment Gateway: What’s the Difference?

- The 32 (Shopping) Days of Christmas: Payment Data Method For Your eCommerce Business

Frequently Asked Questions

What’s the difference between traditional payment routing and Intelligent Payment Routing?

Traditional payment routing is a static process that connects to a single, regional acquiring bank. Even larger businesses that have access to multiple acquiring banks are limited by traditional payment routing as it always follows the same logic for every transaction. This can result in a higher number of declines.

Smart or Intelligent Payment Routing addresses these issues by identifying the most efficient route between available banks. It sends transactions for approval in the most optimal manner based on selected parameters. It is an essential payment processing feature for any business.

How does Intelligent Payment Routing work?

As soon as a customer submits payment, after going through fraud checks, a payment service provider with Intelligent Payment Routing will consider all the transaction’s applicable criteria. The technology will instantly determine which acquiring bank has the highest possible success rate and will route the transaction appropriately.

What is Intelligent Payment Routing?

Intelligent Payment Routing is automatic transaction routing between multiple acquiring banks to increase the success rates of payment conversions — including failovers and subscription retries.

What is BlueSnap?

BlueSnap helps businesses accept global payments a better way. Our All-in-One Payment Orchestration Platform is designed to increase sales and reduce costs for all businesses accepting payments.

BlueSnap supports payments across all geographies through multiple sales channels such as online and mobile sales, marketplaces, subscriptions, invoice payments and manual orders through a virtual terminal.

And for businesses looking for embedded payments, we offer white-labeled payments for platforms with automated underwriting and onboarding that supports marketplaces and split payments.

With one integration and contract, businesses can sell in over 200 geographies with access to local acquiring in 45+ countries, 110+ currencies and 100+ global payment types, including popular eWallets, automated accounts receivable, world-class fraud protection and chargeback management, built-in solutions for regulation and tax compliance, and unified global reporting to help businesses grow.

Who can use BlueSnap?

Merchants around the world can use BlueSnap to accept payments in 200 geographies with BlueSnap local acquiring in 47.