If you’re an independent software vendor (ISV), your customers expect you to provide them with a way to accept payments. But what if the processor you select could also become a major selling point for your product? Imagine if you could offer payment processing that:

- Promotes more sales around the world;

- Reduces fraud-related losses;

- Helps avoid chargebacks and dispute them;

- Is competitively priced.

The right integrated payment gateway can do all these things—and the better the payment processor, the more business you can attract.If you’re looking to give your software a competitive advantage, then give it a powerful payment processing engine. Click To Tweet

But before you can offer anything, you need to know more about how integrated payment gateways work. The right payment gateway should be right for you as well as for your customers (because you have needs, too!). So take a look below at our overview of integrated payment technology, and the four things you should evaluate before you choose.

Want to know how your platform could benefit from a BlueSnap integrated payment gateway? Talk to us!

How Does An Integrated Payment Gateway Work?

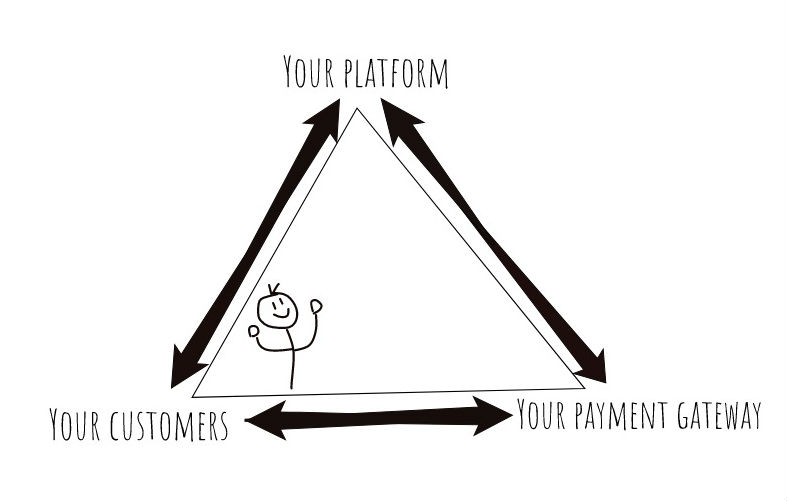

The triangle above represents the relationship between three parties involved in a payment gateway integration scenario:

- your platform,

- your customer,

- the payment gateway.

Let’s say a software company (platform) has integrated a payment gateway into its product or service. This means the software company’s customers can accept payments from their own customers (a relationship not shown on the triangle; they are referred to below as “end users”) directly through the software, and your payment gateway handles the processing of those payments. Thanks to integrated payment technology working behind the scenes, a transaction looks like this:

|

An end user clicks “Buy” to make a purchase. A checkout page appears within the software application. The end user fills in the required information and submits the form. The gateway processes the payment transaction (see the details of that process here) and delivers a confirmation (or decline) to the software company. The software company informs the customer that payment is complete. |

Voila! Because the end users never have to leave the software they were using to make a purchase, the process is quick and easy, and it enhances their experience as a whole.

How does a platform connect with a payment gateway?

The integrated payment technology most commonly used to connect with a gateway is an API. Using an API integration, the payment gateway provider manages all the tasks necessary to complete the transaction, while giving you, the platform owner, total control of how the checkout page looks and feels. And it still allows you to accept a range of payment types, including credit and debit cards, eWallets, and ACH. That means you can keep customers firmly embedded in your brand experience while serving up a high-quality checkout experience.

If you don’t have the developer resources to do the legwork required for an API connection, consider a hosted checkout page. This option requires no development experience and is a good alternative for easy payment gateway integration.

4 Things To Evaluate In An Integrated Payment Gateway

Whether you’re in search of a payment gateway partner or evaluating a gateway you already have, here are four things to look at that can make for a more prosperous partnership—and get you closer to choosing a payment gateway that will give your product an edge:

Evaluate API quality.

Since you’re likely using an API to integrate, find out a few things about it first:

- How easy is it to implement? The API should be simple and flexible, so you can either code directly or through a Software Developer Kit (SDK). SDKs shorten the window for development time and help accelerate deployment, so your customers can start accepting payments right away!

- Does it provide code samples? Copy-and-paste-ready code samples for all the main use cases should be readily available. They’re easy to use, leave less room for error, and speed up the payment integration process.

- Can you try the API right from the docs? You shouldn’t have to create an account to evaluate a payment gateway API integration, or leave the site you’re on to copy/paste code into an external tool to see the results. If either of those are the case for the API you’re considering, you can do better.

Evaluate the security.

Since gateways deal with transfer of money, security is paramount. There are two aspects to security you should be concerned with:

- Fraud and chargeback management. All payment gateways have some type of fraud protection, but the stronger it is the more your customers are protected. A homegrown fraud detection engine doesn’t cut it. Instead, the gateway you choose should have tools to protect your customers, not only at the time of purchase (with fraud-detection tools) but also after a purchase (with chargeback alerts and notifications and chargeback dispute assistance).

- PCI compliance. Every payment gateway should be compliant with the Payment Card Industry Data Security Standard (PCI-DSS). Find out if the gateway you’re considering has ways to help you reduce your burden of PCI compliance as well as the scope of coverage it provides for your API usage. The payment gateway you choose should do everything in its power to help you achieve compliance, and make it as painless as possible!.

Evaluate the payment processing features.

Which payment gateway has the most to offer your customers? And, more specifically, what payment tools would your customers most appreciate?

- Having high-level support for global transactions would give them a leg up on cross-border sales and help them expand their business.

- Having the ability to accept a wide variety of payment methods and currencies, which they can pick and choose (and change!) as they like, will help increase conversions.

- Having access to extensive, accessible reporting is a must. The more real time data your customers have about their businesses the better business decisions they can make.

- Easy on-boarding helps them get started processing faster. Who wouldn’t like that?

Evaluate the support.

What you really want to know is: Will this integrated payment gateway relationship complicate my life or make it easier? To help make this determination, look at things like developer resources and customer support. Anything that helps developers do their jobs quickly and easily is incredibly valuable, so documentation—like tutorials and getting-started guides—should be easily accessible. They should also be able to test out the solution without jumping through hoops.

Customer support is also key. In addition to technical help and support, you should have ready access to consulting, for help configuring payment solutions that will grow your platform. Ask for references if you want a clear idea of how well the gateway handles support and to see what you can expect for the future.

Find The Right Integrated Payment Gateway For You

Now that you know how integrated payment gateways work and what to look for, it’s time to start looking!

Check out what BlueSnap has to offer when it comes to payments for platforms. Talk to us to find out how we stack up on the criteria listed above, and how our payment processing engine can give you the competitive advantage you need to get ahead. We’re looking forward to hearing from you!

Related Resources: