Payment gateways, payment processors, and merchant accounts — if you’re an eCommerce merchant you know these are all necessities for selling online. What’s less clear for most people, however, are the ins and outs related to each of these concepts, and how choosing and configuring them can impact your business. Whether you’re an eCommerce merchant looking to set up your first store or a growing business interested in switching payment providers, here’s a primer on the basics to help you brush up on a critical aspect of selling online.

Don’t let confusion about the basics of payment processing stand in the way of success. Here’s the lowdown on the foundational aspects of selling online. Click To TweetWhat Is a Payment Gateway?

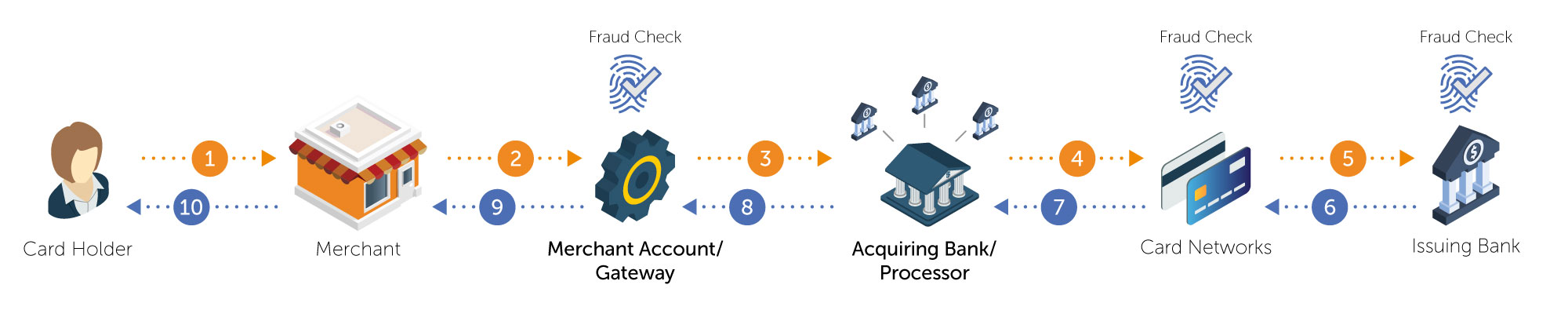

A payment gateway refers to the technology that connects merchants of all kinds — not just online merchants — and payment networks. At its most basic level, a payment gateway does the following (all in under a second!):

- It integrates with your online store. Essentially, it gives your store one or more ways to integrate online card processing capabilities with your business operations.

- It securely captures payment details for customer transactions. The merchant sends the shopper’s information to the payment gateway via tools the gateway provides. To transmit these details securely, the gateway encrypts the payment information during transmission.

- It routes that information to a payment processor or an acquiring bank. The acquiring bank takes over at this point. The acquiring bank may do some fraud screening and then routes the transaction to the card networks.

- It sends an approval or decline message back to the merchant. Based on the yes or no response, the merchant may either direct the shopper to a confirmation page, or ask them to provide another form of payment.

How Payment Gateways Work

What’s a Payment Gateway vs. a Payment Processor?Payment processors provide direct connections for merchants to card networks like Visa or Mastercard; payment gateways connect merchants with processors that then, in turn, connect you to the card networks. Large payment processors don’t work directly with most businesses; instead, they have reseller agreements with payment gateways to provide their services to merchants. (Some payment processors will work with online businesses directly if they are large enough.) |

Beyond the Essentials: What Makes Some Payment Gateways Different from Others?

While every payment gateway does the above, that’s only providing the basics. Many payment gateways go beyond this function and offer a myriad of other services surrounding payment processing, for instance:

- Multiple payment methods: Credit and debit cards aren’t the only way to pay for goods and services online. Many shoppers prefer to use other payment methods, like eWallets, direct debit or bank transfers (especially if you’re selling globally), so you need more than just a card payment gateway. Many payment gateway providers support a variety of payment options so you can attract and retain a greater number of customers.

- Fraud protection services: Online businesses are at risk of attack every time they accept a payment. If your fraud level gets out of control your business will be negatively impacted in the form of chargeback fees and penalties, lost merchandise, and reputational harm. It’s to your benefit to find a payment gateway that has strong fraud detection and prevention tools.

- Recurring billing tools: These days, many businesses use a subscription model to sell goods. It will make your life easier to find a payment gateway that can manage automated billing, send out payment reminders, set up customizable billing plans, and automatically update shoppers’ subscription payment information.

- Detailed payment analytics: Having detailed payments data can help you make better, more informed decisions about how to improve your business. The best payment gateways give you access to a variety of payment analytics and reports that paint a complete picture of where your payment process is succeeding and where it needs some work.

- Some gateways can also provide you with a merchant account. (More information on merchant accounts below.)

Is your current payment gateway limiting your growth? Talk to us about how our All-in-One Payment Platform can help.

If your payment gateway doesn’t have these capabilities, you’ll have to find other ways to satisfy these needs. For instance, you’ll have to integrate to a separate fraud engine in addition to your payment gateway. (Going without a fraud prevention tool is not recommended if you want to run a healthy, successful business!)

The best strategy for most online businesses is to find a single payment gateway that does it all — an all-in-one payment processing solution that supports sales anywhere in the world, provides strong fraud protection, gives detailed payment analytics, and has robust subscription functionality. You’ll find that working with just one payment gateway not only simplifies payments, but also gives you a reliable partner who can help you maximize revenue as you grow.

Now onto the next critical payments piece: the merchant account.

What Is a Merchant Account?

A merchant account is an account that enables merchants to process payments. Your payment gateway (or whatever entity set up the account for you) deposits the funds from your sales there. According to a designated schedule as determined by your payment gateway, the funds are automatically transferred from your merchant account into your business bank account, which you set up for yourself.

A merchant account is different than a business bank account, a point that often causes confusion. You have no control over your merchant account; it’s simply a holding place for deposits. Why can’t the money from sales be deposited directly into your business bank account? Since merchandise can be returned, there’s always the chance that some money you receive as a seller will have to be paid back, which accounts for a certain level of risk in your transactions. Returns are subtracted from whatever sits in the merchant account at that time; the remaining funds are then transferred to your bank account.

Also, your payment gateway may be accumulating deposits from multiple sources. Rather than giving you five different deposits, it collects them in your merchant account and combines them into one single deposit for your bank account, making reconciliation easier.

Changing Your Merchant Account Provider? Your Banking Relationship Can Remain the Same.Merchants sometimes think that when they change providers (and therefore change the source of their merchant account) they must change their entire banking relationship. That’s not true. Because the merchant account is simply a holding place for sales proceeds, you don’t have to change your bank account to match the banking institution your payment provider uses. For instance, you could retain your existing business bank account with Bank A and still choose a payment provider that gives you a merchant account with Bank B — without altering your Bank A relationship. Curious to bust other myths about changing your payment solution? Download The Payment Gateway Switch Kit: Your Ultimate Guide to Switching Providers to understand other common concerns. |

How Do You Get a Merchant Account?

Many payment gateway providers, like BlueSnap, are full-service payment solution providers, which means they provide merchant accounts to their customers along with a payment gateway and processing solution. However, that’s not always the case — some payment gateways leave the merchant account setup to you. That’s not the ideal situation; the fewer providers you have, the better. So we recommend finding a payment gateway that’s also a payment service provider—one that gives you a merchant account and handles payouts.

Beyond the Essentials: What Makes Some Merchant Accounts Different from Others?

Three primary things differentiate merchant accounts:

- Some make global commerce easier. Some merchant accounts can only receive money in USD, whereas an internationally-minded payment gateway provider can set one up to accept multiple currencies. So if you’re looking to grow globally (and you should be!), it’s a good idea to set up a multi-currency merchant account.

- Some have a more sophisticated underwriting process. Not all merchants have an equal level of risk for their transactions, something that should be taken into consideration during the underwriting process. A customized underwriting process leads to fewer problems down the road, and helps avoid an unexpected shutdown of the account due to miscalculations.

- Some are shared, or aggregate, accounts. Some eCommerce merchant accounts are shared among all the merchants serviced by the payment gateway. That means your risk profile is blended in with all the other merchants in the pool, which may be an advantage for some merchants but not for others. Before you sign on with a provider, check whether you’ll have a dedicated or aggregate account, and consider how that might affect your online business.

The Ideal eCommerce Payment Solution: A Global Payment Orchestration Platform

Payment gateways and merchant accounts might sound complicated, but they don’t have to be.

BlueSnap can give you everything you need — a payment gateway, merchant account, and a host of advanced processing features — to sell anywhere in the world successfully. Our Global Payment Orchestration Platform is easy to use (you can turn functionality on or off in a snap, as you need it) and flexible (you have options for extending coverage as your business grows). You can also rely on us for personalized guidance and support when you have questions, or set out to conquer new sales territories.

Do you have payment challenges we can help with? Let us know — we’d love to chat about how we can help.

Related Resources:

- Payment Gateway vs. Full Payment Platform: What’s the Difference?

- Which Type of Payment Gateway is Right for Your Business?

- How to Better Secure Your Credit Card Data

Frequently Asked Questions

What is a gateway?

A gateway connects the merchant to the acquiring bank where the merchant has opened a merchant account.

What is a payment facilitator or payment service provider (PSP)?

A payment facilitator, also known as a payment service provider (PSP), provides a merchant account (MID) and receives settlement from the acquirer to pay the merchant. A payment facilitator offers services to accept credit and debit cards and may offer additional payment methods such as direct debit, online bank transfers or eWallets.

How do digital payments work?

Whether for B2B card processing or B2C card transactions, digital payments work the same:

- The gateway captures the transaction request and either encrypts or tokenizes the information, then routes it to an acquiring bank.

- The acquiring bank (which provides your merchant account) takes ownership of the transaction request. Its job is to get authorization for the transaction.

- The issuing bank assesses the request: Does the customer have sufficient credit or funds? The issuing bank generates a response — yes or no — and sends it back to the acquiring bank via the card network.

- The acquiring bank sends the response back to the payment gateway.

- The payment gateway’s final job is to present the answer either back to the merchant or to the shopper directly (if you’re using a hosted payment page).

Congratulations, your order is approved!