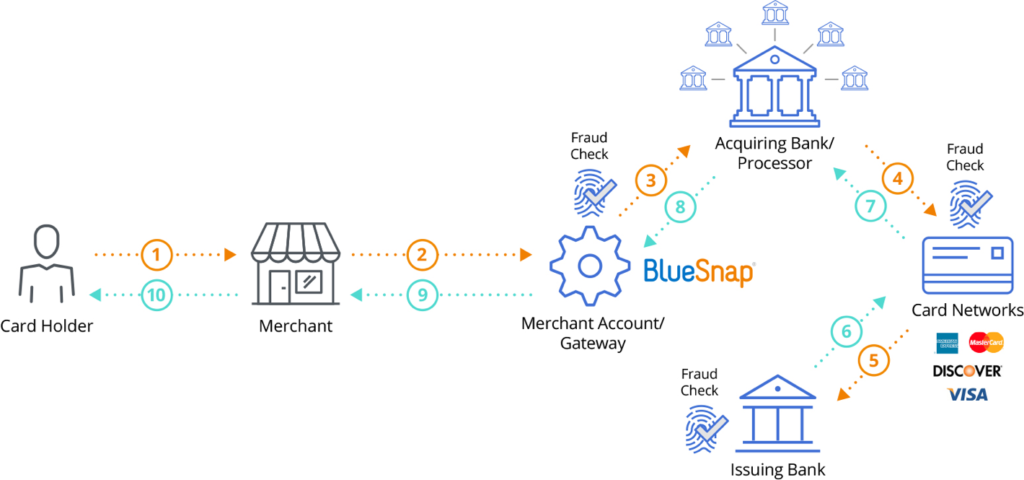

Payment Processing

Merchant account, payment gateway and processor all-in-one.

Our All-in-one Payment Platform will help you take cards online, offer ewallets to your shoppers, integrate your Paypal account and have 110 payment types to choose from so your global shoppers can buy using their preferred payment type.

Merchant Accounts

With all your payment types connected to one merchant account, you will save time reconciling and pulling comprehensive reports.

Payment Gateway

BlueSnap’s All-in-one Payment Platform is truly a global payment gateway, built from the ground up to provide frictionless checkout experiences for domestic and cross-border transactions alike. So, whether you are selling in the US only today, or serving a worldwide market, our payment gateway has the foundation to process your payments now and grow with you as you expand into new markets.

Global Payments

In addition to offering you an international payment gateway for cards, we can help you process payments on a 110 of the most popular payment types around the world. For example Alipay is crucial if you plan to sell into Asia. Sofort is popular in Germany, and Ukash is expected in Russia to name a few. We have taken the work out of maintaining a separate relationship with each payment type you need in each country or region, and integrated these payment types right into our platform.