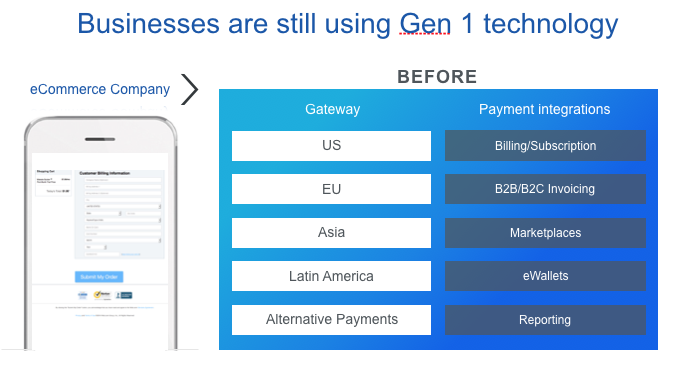

If you’re at the helm of a growing software-as-a-service (SaaS) company, it might seem reasonable to add payment gateways as you expand your business. You might think you need multiple gateways — including ones that serve specific regions around the world — to get the global coverage you need. If this sounds like your philosophy, here’s something you should know: you only need one payment solution.

Skeptical? Check out these benefits of having a single powerful solution.

10 Reasons to Use a Global Payment Orchestration Platform

1. You can reach more global shoppers and achieve higher conversion rates.

Compared to other types of businesses, SaaS companies can grow relatively quickly because it’s easier to start selling internationally (no dealing with shipping and logistics). The right payment solution can help you increase your authorization rates.

For example, BlueSnap helps you succeed and accept payments everywhere you expand thanks to our intelligent payment routing technology and numerous global bank partners. We’re not just processing all transactions the same way; instead, we evaluate where to send each transaction to increase its chances of approval. As a result, you get the best payment conversion rates in every region around the world.

2. You get a complete selection of global payment types and eWallets built-in.

Another important part of the global sales equation is offering payment types that are familiar to your customers. As you expand into new countries, you need to move beyond cards and offer each region’s dominant payment methods.

Alipay, SEPA Direct Debit, Giropay, iDEAL and Sofort are just some examples of popular international payment methods we support. You also get access to all the popular eWallets, including Apple Pay, Google Pay and Click to Pay. There’s no need for a specialized gateway when you can get more than 100 of the world’s favorite payment methods from a single connection to BlueSnap.

3. You gain internal efficiencies with a single vendor.

Having one gateway instead of 3, 5, 10 or 20 has numerous benefits: You no longer have to manage multiple vendors, contracts and relationships. You minimize IT involvement by doing away with administering multiple accounts and integrations, and you’re simplifying accounting operations by having only one account to reconcile. Streamlining is sweet.

Wondering how to get started transitioning to BlueSnap? Download this free whitepaper for our recommended to-do items.

4. You get an award-winning subscription engine for recurring billing.

Most likely, your payment structure revolves around subscriptions or recurring payments based on usage. With BlueSnap’s platform, you’ll get a robust subscription billing engine that can support whatever pricing plans you want to offer your customers. You can also easily configure and manage different customized payment plans and tiers and add promotions and coupons, giving you the ability to be flexible in your offerings. Even better, we can help you automate your entire accounts receivable function to help you get paid faster and streamline efficiencies.

5. You get account updater functionality to optimize subscription payments.

Subscription payments are convenient — except when you have to chase down card information that has changed. Our Account Updater feature automatically updates cards for you behind-the-scenes to ensure that whenever cards expire, get lost or get stolen, the payment information is current before the next charge. This feature can rescue up to 10% of lost sales.

6. You get marketplace functionality that supports third-party software plug-ins.

Do you work with third-party software developers who sell add-ons to your product? Are you looking to create a marketplace to generate more revenue? BlueSnap’s Marketplace solution gives vendors a way to sell their add-ons to your customer base by facilitating the distribution of payments. By making it easier for developers to sell their related products, you’re increasing your own visibility and bringing in more sales.

7. You get scalable architecture to easily reach new sales channels.

Once you set up our payment system, it’s easy to add checkout capability to future lines of business. And invoice payments get paid faster when you use our Payment Link functionality, which allows you to send an invoice via email or embed the link directly in the invoice. Your customer service reps can also take orders over the phone via our Virtual Terminal.

8. You get a modern, easy-to-use REST-based API.

Payment gateways have been around for decades, but not every platform is dedicated to keeping its architecture up to date. BlueSnap invests heavily in our technology stack to ensure you’re getting a leading-edge platform that is scalable and stable. We use a Spring-based Java framework running on Linux OS and provide RESTful APIs. We plan to continue to extend our offering to keep it modern and in line with industry best practices.

9. You get the ability to connect payment functionality with hundreds of integrated business platforms.

Like many other SaaS companies, you’re probably using Salesforce, Netsuite, Zuora or some other technology partner to help you with various aspects of your business, like customer relationship management or accounting. BlueSnap integrates with hundreds of business platforms, making it easy for you to access your payment data within the systems you already use.

10. You get a comprehensive fraud stack to help you manage risk.

As your SaaS business grows it’s easy for fraudulent activity to grow along with it. BlueSnap’s complete fraud stack protects your business at every phase of the buying process, including stopping criminal fraud in real time and resolving disputes before chargebacks occur. Our sophisticated fraud-prevention tools meet industry security standards, meaning you can focus less on fraud management, and more on business expansion.

Related Resources:

- BlueSnap named a SaaS Award winner for Best SaaS for E-Commerce

- Online Payment Advice to Boost Your B2B Business

- 4 Tips for Managing SaaS Subscriptions for Global Customers